The art world is no stranger to volatility, but recent policies under President Trump are sending ripples through art funds—specialized investment vehicles that treat artworks like financial assets. From tariffs to proposed cuts in federal arts funding, these changes are reshaping how art funds operate, with both challenges and opportunities on the horizon. Here’s what’s happening and what it means for investors and the broader art market.

Tariffs: A Costly Uncertainty

Trump’s trade agenda, including a 10% baseline tariff on all imports and higher rates for countries like China (20%), Mexico, and Canada (25%), has art funds on edge. While artworks may be exempt under current tariff schedules, the uncertainty is already impacting international trade. Shipping and customs costs are climbing, and some galleries are rethinking participation in U.S. art fairs to avoid the hassle. For art funds, which often rely on global auctions and collectors, this could mean slimmer margins and tougher deals.

The broader economic fallout doesn’t help. On April 3, 2025, billionaire wealth dropped by $208 billion amid tariff-related market swings, signaling caution among high-net-worth collectors who fuel art fund investments. While a recent pause on some tariffs offers temporary relief, the lingering 10% import tax could still raise costs for funds with international portfolios.

Arts Funding Under Fire

Federal support for the arts is facing its toughest test yet. Trump’s executive orders, including one signed on March 14, 2025, target agencies like the Institute of Museum and Library Services (IMLS), which funds museums and cultural projects. The National Endowment for the Arts (NEA) and National Endowment for the Humanities (NEH) are also at risk, with potential grant cuts or staff reductions of up to 80%. Organizations like PA Humanities have already seen NEH grants terminated abruptly.

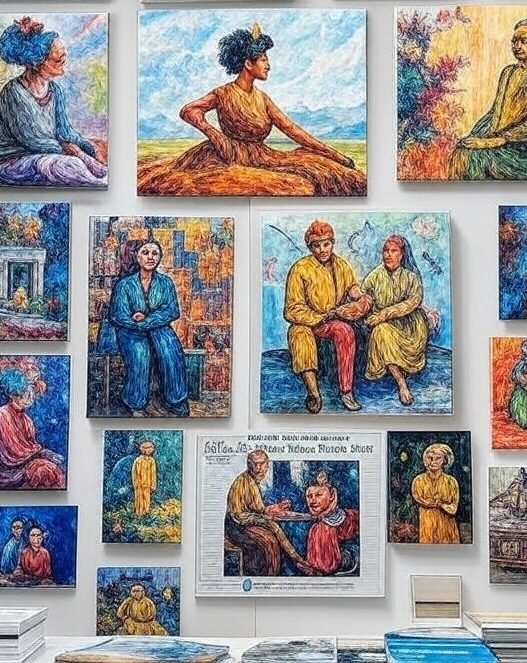

Why does this matter for art funds? Public funding keeps the cultural ecosystem alive, supporting emerging artists and community projects that funds often scout for undervalued talent. Without it, opportunities to invest in the next big thing could dry up, forcing funds to compete for pricier, established works. The loss of programs like those backed by the IMLS could also shrink museum acquisitions, limiting the market for art fund assets.

Tax Policies: A Double-Edged Sword

Trump’s tax policies add another layer of complexity. His 2018 Tax Cuts and Jobs Act ended a provision allowing collectors to defer capital gains taxes by reinvesting in art, which slowed the secondary market—a key space for art funds. If similar restrictions return, funds focused on resales could struggle. On the flip side, proposed tax breaks for the ultra-wealthy could put more money in collectors’ pockets, boosting demand for high-end art. Funds specializing in blue-chip artists like Basquiat or Warhol might see an uptick, while those betting on experimental works could face headwinds.

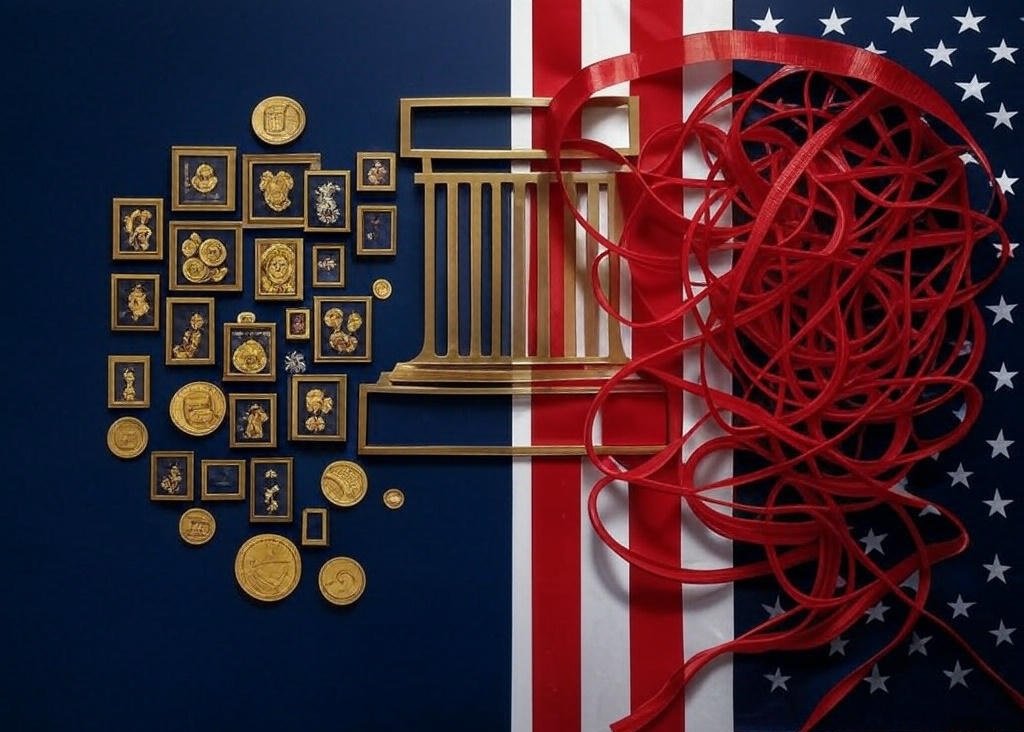

Cultural Shifts and Market Vibes

Beyond economics, Trump’s cultural agenda is stirring the pot. His administration has dismantled groups like the President’s Committee on the Arts and Humanities and cracked down on diversity, equity, and inclusion (DEI) initiatives. A Black Lives Matter mural in Washington, D.C., was demolished under funding cut threats, hinting at a conservative push that could sidelined socially engaged art. Funds tied to contemporary or progressive artists might lose appeal among risk-averse investors, while those focused on traditional genres—like the resurgent antiques market—could find safer ground.

Can Art Funds Adapt?

Despite the challenges, art funds have a knack for resilience. Historically, they’ve weathered economic storms by diversifying or doubling down on domestic markets to dodge tariff costs. The antiques boom at fairs like Tefaf Maastricht suggests a pivot toward historical art could be profitable. Funds might also lean into U.S.-based artists to sidestep import headaches, especially as collectors grow cautious amid policy uncertainty.

Still, the road ahead isn’t easy. Art funds will need to balance rising costs, a shrinking public art scene, and shifting collector tastes. Congressional pushback might soften some cuts—bipartisan support saved the NEA and NEH before—but funds can’t bank on it. Smart players will hedge their bets, mixing high-value assets with emerging domestic talent to stay afloat.

What’s Next?

The art fund landscape in 2025 is a mixed bag of risk and reward. Tariffs and funding cuts threaten profitability, but tax incentives and market adaptability offer hope. For investors, the key is flexibility: funds that can navigate Trump’s policy maze while tapping into resilient niches—like antiques or American art—stand the best chance of thriving.

As the art world watches these policies unfold, one thing’s clear: creativity isn’t just for artists. Art funds will need every bit of it to turn uncertainty into opportunity.