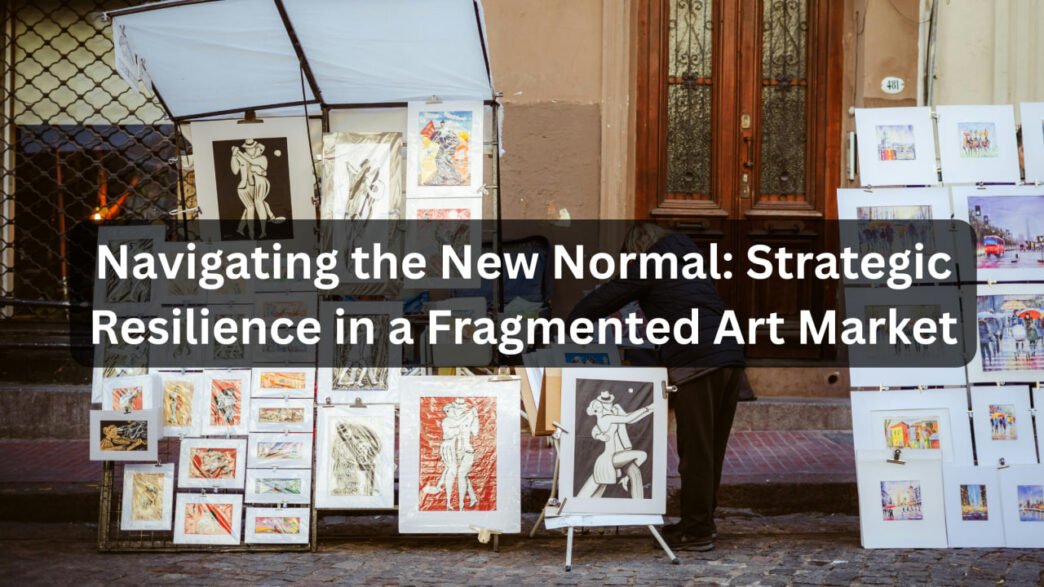

Following a period of global economic contraction, the art market of late 2025 is characterized not by dramatic decline, but by a strategic and nuanced shift in collector behavior. While headline-grabbing “trophy lot” sales have slowed, creating an overall dip in total auction value, the market’s true resilience is being forged in the mid-range ($1M–$10M) and entry-level segments, driven by a new guard of selective and informed buyers.

For gallerists, advisors, and collectors, this moment demands a departure from speculative exuberance and a focus on transparency, diversification, and the long-term fundamentals of quality and provenance.

The Two-Speed Market: Mid-Range Momentum vs. High-End Pause

Analysis of the first half of 2025 reveals a clear segmentation:

| Price Bracket | H1 2025 Sales Change (YoY) | Key Collector Behavior |

| Over $10M (High-End) | -22.4% | A significant slowdown in “masterpiece” transactions and speculative ultra-contemporary flips. Caution and risk-aversion dominate, with a preference for private sales to manage downside risk. |

| $1M–$10M (Mid-Range) | +13.8% | The strongest growth area. Collectors are consolidating positions in market-tested contemporary and modern artists, seeking “safer bets” with strong institutional backing and established secondary markets. |

| Under $1M (Entry-Level) | +5.2% | Driven by Millennial and Gen Z buyers, who now account for up to one-third of total auction activity. Fierce competition for breakout emerging artists, but only when priced appropriately and transparently. |

Export to Sheets

The data confirms a widespread flight to quality and away from market speculation. Collectors are seeking equilibrium, demonstrated by an increase in sell-through rates across auction houses, indicating a greater agreement between buyers and sellers on fair pricing.

Shifting Collector Behavior: The Drive for Transparency

Perhaps the most significant structural change is the evolving mindset of the collector base, particularly the younger demographic.

- The Digital-Native Collector: Younger buyers (age 36 and under) are decidedly online-first. They are more likely to purchase art sight-unseen and use digital marketplaces for discovery. Critically, these collectors demand a level of clarity that the traditional market has often resisted. Surveys indicate that a lack of price transparency is cited by up to 69% of collectors as a major obstacle to buying art.

- The “Responsible” Acquisition: There is a distinct move away from purely investment-driven purchases toward acquisitions rooted in building meaningful collections and directly supporting artists. This cohort prioritizes ethical engagement, including direct studio purchases and supporting community-driven art spaces, signaling a broader cultural re-evaluation of the art object’s social role.

- Diversification Beyond Fine Art: Non-fine art categories—such as design, luxury jewelry, and collectible wine/whiskey—have seen surges (some reporting +20−63% growth in H1 2025). This is attracting “crossover collectors” and underscores a broader diversification strategy among high-net-worth individuals who see alternative assets as a crucial hedge against uncertainty.

Strategic Imperatives for the Art World

In this environment, success hinges on adaptation:

- For Galleries: The imperative is to enhance the digital ecosystem. Over 40% of galleries are increasing focus on online sales, recognizing that a professional online viewing room with transparent pricing is no longer optional—it is a baseline requirement for engaging new and younger clientele. Educational content, behind-the-scenes access, and exclusive previews remain highly valued by collectors.

- For Auction Houses: The focus has shifted to de-risking high-value consignments. An increasing reliance on third-party guarantees ensures major lots sell, while strategic focus on private sales provides discretion and price control for cautious sellers in a volatile top-end.

- For Collectors & Advisors: Strategy should prioritize blue-chip stability in the mid-range and carefully vetted emerging talent in the entry-level. The days of chasing meteoric price spikes for unproven names are over; research, institutional history, and an artist’s commitment to their practice are the key metrics for sustainable value appreciation.

The art market is not stalling; it is recalibrating. The late 2025 landscape is a proving ground for longevity—rewarding measured, well-researched, and transparent engagement over speculative fervor. Those who adapt to the new collector mandate for information and responsible practice will be best positioned for sustained growth in the years ahead.